|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Are Wall Street Analysts Predicting General Dynamics Stock Will Climb or Sink?/General%20Dynamics%20Corp_%20sign%20in%20San%20Jose%2C%20Ca-by%20Michael%20Vi%20via%20Shutterstock.jpg)

With a market cap of $85.1 billion, General Dynamics Corporation (GD) is a global aerospace and defense leader with a diverse portfolio spanning business aviation, shipbuilding, land combat systems, and advanced technologies. Organized into four segments: Aerospace; Marine Systems; Combat Systems; and Technologies, the company delivers innovative solutions to commercial and defense customers worldwide. Shares of the Reston, Virginia-based company have lagged behind the broader market over the past 52 weeks. GD stock has risen 8.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.9%. However, shares of the company are up over 21% on a YTD basis, outpacing SPX’s 9.8% gain. Focusing more closely, General Dynamics stock has underperformed the Industrial Select Sector SPDR Fund’s (XLI) 19.6% return over the past 52 weeks.

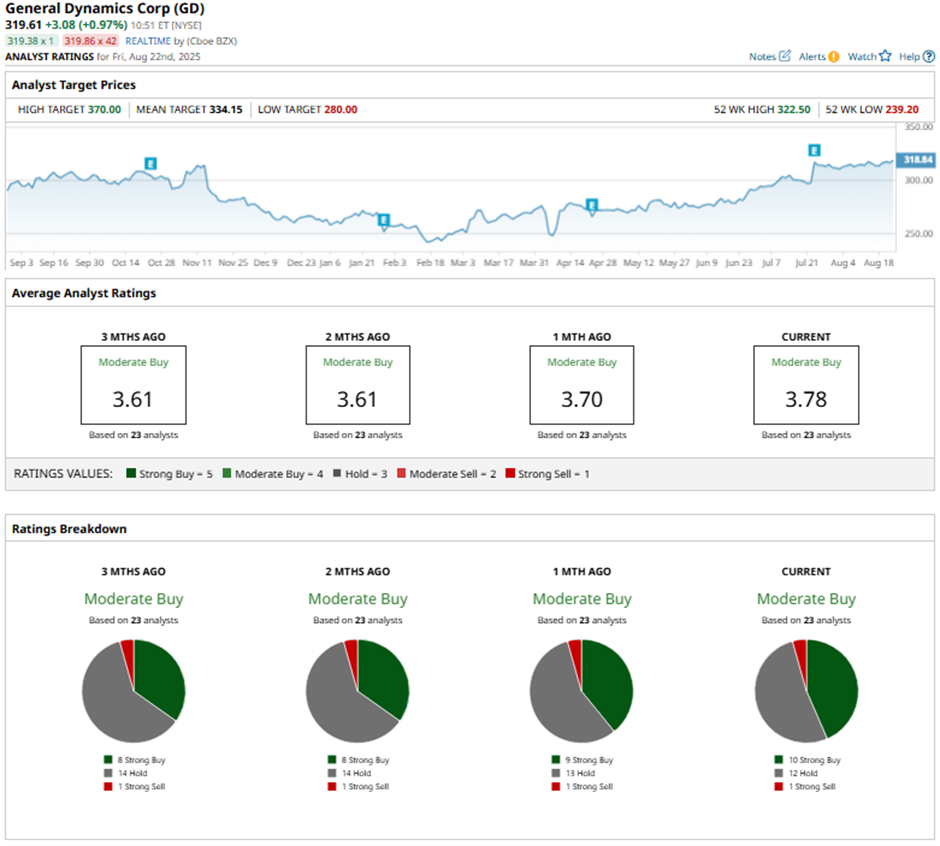

Shares of General Dynamics surged 6.5% on Jul. 23 after the company reported strong Q2 2025 results, with EPS of $3.74 beating the consensus estimate and rising 14.7% year-over-year. Revenues climbed 8.9% to $13.04 billion, surpassing estimates, driven by double-digit growth in Marine Systems and solid gains in Aerospace and Technologies. Investor sentiment was further boosted by the company’s record $103.7 billion backlog, up sharply from $88.66 billion in Q1, signaling robust demand across its defense and aerospace businesses. For the fiscal year, ending in December 2025, analysts expect GD’s EPS to grow 11.5% year-over-year to $15.20. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion. Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, 12 “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with eight “Strong Buy” ratings on the stock. On Jul. 29, Barclays raised its price target on General Dynamics to $350 while maintaining an “Overweight” rating. The mean price target of $334.15 represents a 4.5% premium to GD’s current price levels. The Street-high price target of $370 suggests a 15.8% potential upside. On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|